|

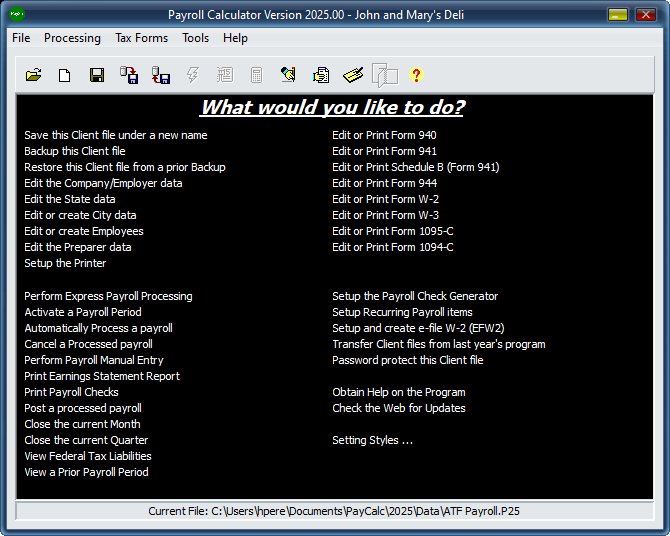

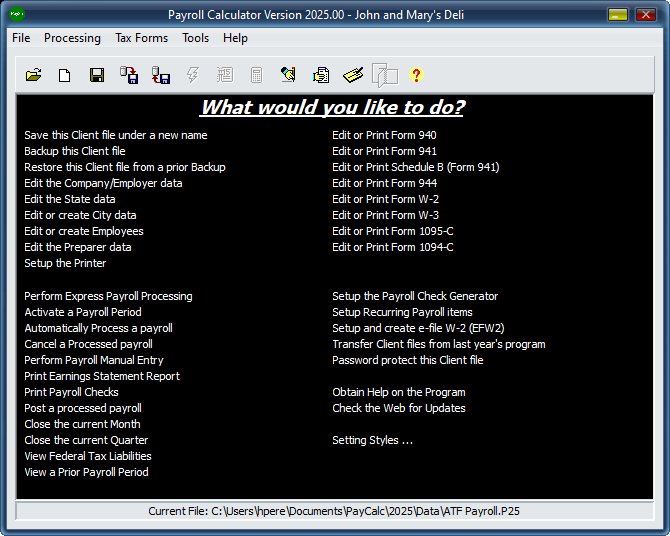

Payroll Accounting can be a tremendous burden for any business. You have to

keep track of hours, salaries and wages, withholding allowances, vacation and

sick time, bonuses and advances, as well as company payments to state and

federal government, and private pension plans. With PayCalc, you can handle

the payroll of one company or numerous companies quickly and easily. Here is

what PayCalc can do for you:

Multi Company Support. Create an unlimited number of companies (your only

limitation is disk space), capable of supporting up to 250 employees per

company.

State Payroll Processing Support. Support for all 50 states and U.S.

possessions. Plus multi state support per company.

City Payroll Processing Support. Support for multi city income tax withholding.

Comprehensive Employee Payroll Processing. PayCalc performs all of the

following payroll tasks:

Calculates wages and salaries for each pay period.

Calculates federal and state taxes, including U.S. possessions.

Prints payroll checks (on virtually any check type or you can generate your own), with earnings,

deductions, and year-to-date detail provided on the voucher (if using voucher checks), or on a separate

pay stub that is automatically created and can be printed for the employees.

Employees can be paid on a weekly, biweekly, semimonthly, or monthly basis.

Handles different types of compensation: salary, hourly, overtime, or a combination.

Keeps track of vacation and sick time.

Tracks deferred compensation plans, tips, union dues, and many other nonstandard payroll payments.

Allows you to setup standard regular and overtime hours for each employee.

Allows you to setup extra taxes, deductions, and employer liabilities in addition to the standard taxes,

deductions, and employer liabilities.

Observes deduction limits for social security taxes and other deductions.

Tracks company liability for federal and state taxes.

Tracks employee historical data: date hired, date of last raise or promotion, amount of initial salary,

prior salary, amount of raise, etc.

Tracks hours worked, keeps month, quarter, and year-to-date totals for all employees, and this

information can be printed.

Tracks employee payments by department, and this information can be printed.

Calculates and prints Forms 940, Schedule A (Form 940), Form 940-V, Form 941, Form 941-V, Schedule B (Form 941),

Form 944, Form 944-V, Form W-2, Form W-3, ACA Forms 1094-C and 1095-C and Form W-4 calculation.

Bullet Proof Payroll. PayCalc performs extensive error checking to ensure the accuracy of the

payroll.

Automatic Processing. With just a few mouse clicks or key strokes PayCalc will perform automatic

payroll processing on all employees at once. Just think of it, what used to take hours with manual

processing, now takes seconds to perform.

Manual Entry. PayCalc is extremely flexible. It allows you to modify and re-process the payroll of

any or all employees. It is you (the user), who has the final say on how the payroll is to be processed.

Pop-Up Calculator. PayCalc comes equipped with a pop-up calculator that allows you to perform any

type of computation on a dollar amount data entry field, via a Put and Get command buttons.

Password Protection: You can optionally select to password protect individual client files.

Payroll Check Generator: PayCalc can be set up to generate payroll checks on the fly, all you need

is the blank check stock. PayCalc provides the Magnetic Ink Character Recognition (MICR) typeface required

for printing checks.

NOTE: PayCalc will only print the data required to generate payroll checks. You must obtain and furnish the

authorized blank check stock.

Employee Labels: You can print employee address labels. The program supports Avery® 5160

address labels. With this type of label you can print up to 30 employees on a single sheet. Also, the

program will automatically print the Post Net Bar Code for any employee whose "Zip Code"

field contains a Zip+4 Zip Code format (XXXXX-XXXX).

Direct Deposit: In cooperation with CPR Systems, PayCalc supports the capability to Direct Deposit

your payroll checks. For a more detailed explanation on how to setup for Direct Deposit; at the PayCalc

Main Menu click on Help/Direct Deposit.

Forms W-2 eFile Support. Our EFW2 Module will make it possible for users to setup a submitter information and

the creation of an EFW2 text file which conforms to the Social Security Administration's (SSA), rules and

specifications (per Publication 42-007), which can then be uploaded to the Business Online Services (BSO). A

Login.gov or ID.me account must be setup prior to setting up an account with the BSO. Once you have setup an

account with Login.gov or ID.me, navigate to www.ssa.gov/bso and setup an

employer account.

Web Update Feature: You can update your copy of PayCalc manually from within the program, or let PayCalc

do it for you, as it does so automatically about every 15 days. An internet service provider is required for this

feature.

Technical Support: If you get stuck on a particular operation, strike the F1 function key to get

immediate context sensitive help. Still stuck? you can call, fax, or E-Mail your problem to us. Every

PayCalc user is entitled to free and unlimited technical support.

Price: $129.00 for new users, $89.00 for annual upgrades.

Fall Pricing Policy

Purchase the program within the last 120 days of this year and you

will receive a free upgrade to the

2026 version once it is released.

To download a PayCalc demo click here

PayCalc Tutorial

PayCalc Tips

Developments Page for 2025

home |

products |

support |

purchase |

search |

downloads

Copyright © 2025 HJP Associates, Inc. All Rights Reserved

27556 visitors since June 1, 2000

|